This came up in another topic and it really has had my mind going. It wasn’t really “on topic”, and I really don't think it fit the intended "tone" of Marty's topic, so figured it deserved its own. LOL

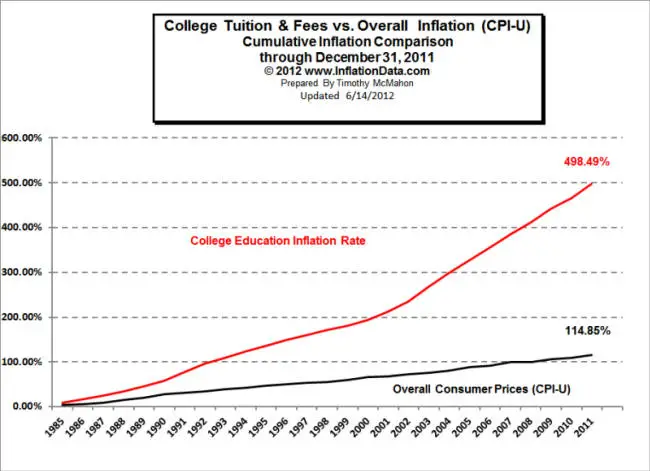

The start was the current “hot topic” of Government Funded Student Loans and their possible effect on the unreasonable inflation of College tuition. One school of thought feels that because the Colleges “know” that the students have “access” to more money, through these loans, they have inflated their prices. The idea is that by removing these loans, the cost will go down, that’s how the economy works. Another justification for removing these loans is that it is unconstitutional to expect taxpayers to fund someone else’s education. If you can’t afford it, then get a private loan, if you don’t qualify, then you don’t get the loan. Simple.

For me it seems obvious that at one point these loans were more accepted, when they were first introduced. At that point, the economy would have been better, tuition more affordable and college was not a “given”, not everyone expected to attend, so obviously less demand for these loans. Over time though, the colleges have abused the situation, increasing fees exorbitantly, knowing the government/taxpayer would fit the bill. In addition, it has been drilled into our minds that College is the only option if you hope to have a financially stable future. Finally, financial advisors have mastered how to work the system to get the most out of it and benefit their customers. Loans that originally were rewarded to a more limited specific group who were exceptionally driven but financially unable, are now just being over issued and feeding the original problem they meant to solve.

For me, it is very hard to decide exactly where I stand on this issue. I think it is as much a philosophical one as it is a political one. These loans did serve a purpose and were awarded with good ethical intent. Help motivated students so they have the same opportunity as everyone else. It was the bad side of the free market that abused them and took advantage of the situation. Firstly, the product being sold didn’t improve and justify a price increase. It was just pretty much: Student, “How much is tuition?” College: ”I don’t know? How much you got? “(big toothy grin). Secondly, it became a “science” getting the loans. Financial advisors used their ability to get as much money out of the system for their clients as possible, whether or not they were the most “needy” students. Logic would tell me, the students who really needed the money, with lower income, are not the students who have the contacts or income to hire a financial advisor to get them the money.

So for me, so far, a good honest program is ruined by greed. Up to this point, it would seem like taking the money away from the truly needy and motivated students would be ethically wrong on every level. The idea that the motivated financially challenged students lose their loans because the not so needy outsmarted the system is horrible. Additionally, if put into the private sector, what is to say that Private Loan companies won’t give out just as many loans as the government did, therefore keeping the price of Colleges just as high.

The second justification for removing the loans, the constitutional one that is a bit more depressing, seems to make more sense. Remove the loans because Tax Payers should not be forced to pay for someone else’s education. Let’s say that was justifiable, though it may be considered harsh, I don’t think it is really unjust. Should anyone really be “forced” to help those less fortunate? Shouldn’t that be a choice that we all have the freedom to make?

At the end of the day, how is the success or greatness of our Country measured? If we stay focused on our AAA rating, stop the loans, stop the handouts, focus on making our economy thrive, expect the money to trickle down, is that Success? If we are relying on the idea that “greed” is the only true motivator, and that motivation makes the whole economy work, how can we also say that the “greedy” will be honest enough, to not find a way to stop the money from trickling down, to catch it for themselves, like with student loans. Doesn’t this entire Student Loan situation sort of show how a free economy will totally abuse and corrupt any program aimed at the lower class? Wouldn’t the same principal, greed, that makes the free market thrive stop it from benefiting the “lower class”?

Wow, I should probably just stop typing … hmmmm ….

The start was the current “hot topic” of Government Funded Student Loans and their possible effect on the unreasonable inflation of College tuition. One school of thought feels that because the Colleges “know” that the students have “access” to more money, through these loans, they have inflated their prices. The idea is that by removing these loans, the cost will go down, that’s how the economy works. Another justification for removing these loans is that it is unconstitutional to expect taxpayers to fund someone else’s education. If you can’t afford it, then get a private loan, if you don’t qualify, then you don’t get the loan. Simple.

For me it seems obvious that at one point these loans were more accepted, when they were first introduced. At that point, the economy would have been better, tuition more affordable and college was not a “given”, not everyone expected to attend, so obviously less demand for these loans. Over time though, the colleges have abused the situation, increasing fees exorbitantly, knowing the government/taxpayer would fit the bill. In addition, it has been drilled into our minds that College is the only option if you hope to have a financially stable future. Finally, financial advisors have mastered how to work the system to get the most out of it and benefit their customers. Loans that originally were rewarded to a more limited specific group who were exceptionally driven but financially unable, are now just being over issued and feeding the original problem they meant to solve.

For me, it is very hard to decide exactly where I stand on this issue. I think it is as much a philosophical one as it is a political one. These loans did serve a purpose and were awarded with good ethical intent. Help motivated students so they have the same opportunity as everyone else. It was the bad side of the free market that abused them and took advantage of the situation. Firstly, the product being sold didn’t improve and justify a price increase. It was just pretty much: Student, “How much is tuition?” College: ”I don’t know? How much you got? “(big toothy grin). Secondly, it became a “science” getting the loans. Financial advisors used their ability to get as much money out of the system for their clients as possible, whether or not they were the most “needy” students. Logic would tell me, the students who really needed the money, with lower income, are not the students who have the contacts or income to hire a financial advisor to get them the money.

So for me, so far, a good honest program is ruined by greed. Up to this point, it would seem like taking the money away from the truly needy and motivated students would be ethically wrong on every level. The idea that the motivated financially challenged students lose their loans because the not so needy outsmarted the system is horrible. Additionally, if put into the private sector, what is to say that Private Loan companies won’t give out just as many loans as the government did, therefore keeping the price of Colleges just as high.

The second justification for removing the loans, the constitutional one that is a bit more depressing, seems to make more sense. Remove the loans because Tax Payers should not be forced to pay for someone else’s education. Let’s say that was justifiable, though it may be considered harsh, I don’t think it is really unjust. Should anyone really be “forced” to help those less fortunate? Shouldn’t that be a choice that we all have the freedom to make?

At the end of the day, how is the success or greatness of our Country measured? If we stay focused on our AAA rating, stop the loans, stop the handouts, focus on making our economy thrive, expect the money to trickle down, is that Success? If we are relying on the idea that “greed” is the only true motivator, and that motivation makes the whole economy work, how can we also say that the “greedy” will be honest enough, to not find a way to stop the money from trickling down, to catch it for themselves, like with student loans. Doesn’t this entire Student Loan situation sort of show how a free economy will totally abuse and corrupt any program aimed at the lower class? Wouldn’t the same principal, greed, that makes the free market thrive stop it from benefiting the “lower class”?

Wow, I should probably just stop typing … hmmmm ….

Last edited by a moderator: